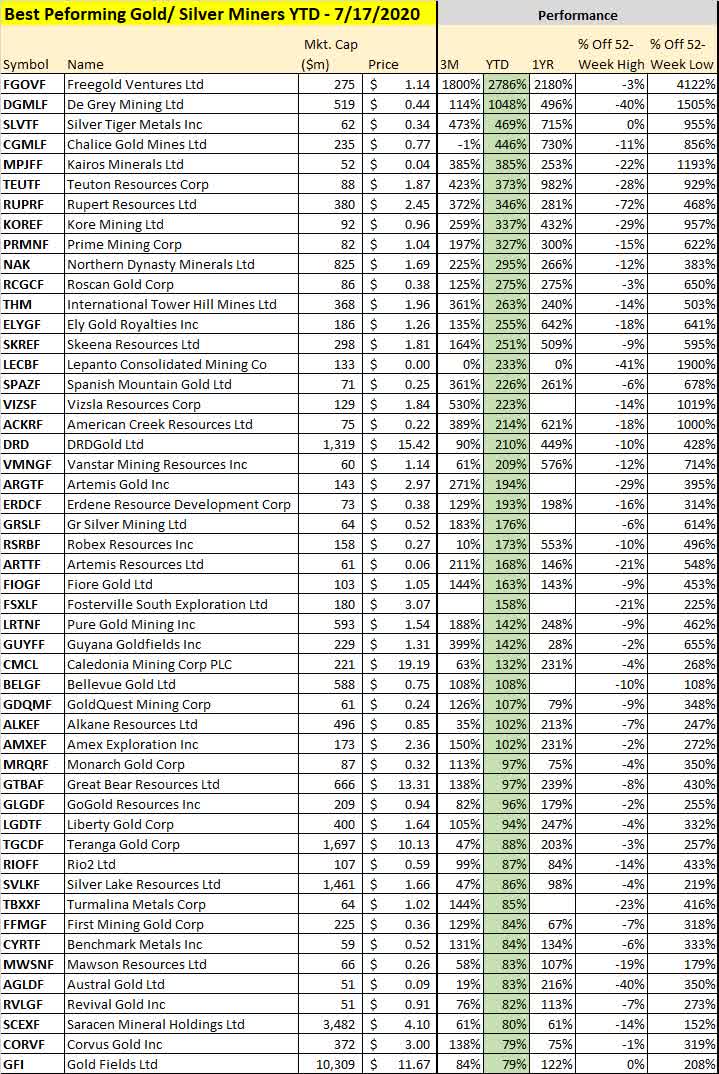

These are the Best Gold and Silver Companies for Your Investment Needs

- Investing in gold and silver is an effective way to diversify your investment portfolio, but you may be wondering where to start.

- Below, we explore some of the best gold and silver companies that you may want to consider.

- Gold and silver are precious metals with intrinsic value.

Gold and silver are both precious metals. Gold is the yellow metal, which is chemically inert, hypoallergenic, malleable, dense, and has a high economic value. Silver, on the other hand, is a soft white metal that is malleable and ductile with a high electrical conductivity. These metals have intrinsic value and are sought-after in various industries, including electronics, medicine, jewelry, and coinage.

Investing in gold or silver is an effective way to diversify your investment portfolio, but you may be wondering where to start. Below, we explore some of the best gold and silver companies that you may want to consider.

Gold and Silver

Buying gold and silver coins can be a smart way to invest in precious metals. Often, investors buy gold coins or bullion coins (bullion coins are true gold coins that have been minted by a government).

Gold and silver are both precious metals, and both will fluctuate in value based on supply and demand. Silver has been valued for thousands of years, while gold only became valuable in the last couple of centuries.

Goldcorp Inc.

(GG)

Goldcorp Inc., headquartered in Vancouver, Canada, is the world's largest gold mining company by market capitalization. Its operations include five mines in Canada, one mine each in Mexico and the United States, and 13 development projects. Its flagship project is the Penasquito mine and mill complex in Mexico, which has an annual capacity of 1.6 million ounces of gold, 15 million ounces of silver, 2.5 billion pounds of copper, and 1.5 billion pounds of molybdenum.

Newmont Mining Corporation

Newmont Mining Corporation (NEM) is one of the world's largest gold mining companies. It produces around 5.8 million ounces of gold annually, with reserves 44 million ounces of gold. Newmont is the world's largest gold producer by output, and the largest gold producer in the United States.

Silver Wheaton Corporation

Silver Wheaton Corp. (SLV) is a silver streaming company. It is one of the largest producers of silver in the world. Silver Wheaton currently provides investors with exposure to silver through three primary products: silver streaming, silver bullion, and silver mining. The company's primary product is silver streaming, in which Silver Wheaton delivers silver products in exchange for a silver stream royalty.

Silver Wheaton's silver streaming royalty business enables it to sell silver products at higher prices. The company's silver streaming royalty business generates 94% of its revenue from silver streaming. The remaining 6% of its revenue comes through silver bullion and silver mining. Silver bullion and silver mining only generate a small 1% and 3% of its revenue, respectively.

The company currently trades at $18.58 a share, giving it a market capitalization of $2.7 billion. This stock price is up 25.3% over the last year.

Barrick Gold Corporation

Founded in 1983, Barrick Gold Corporation (ABX) is one of the largest gold producers in the world. Barrick's principal asset is a portfolio of 27 producing gold mining operations and development projects located in 10 countries. Barrick's portfolio is one of the largest gold reserves in the world.

Gold Resource Corporation

Gold Resource Corporation (NYSE: GORO) is a mining company focused on developing and operating gold mines. Its primary asset is the Mesquite mine in Nevada, which is undergoing an expansion to more than double its annual production rate to 600,000 ounces. The company's shares trade at 36 times analysts' earnings forecasts for 2020, which is in line with its five-year average.

Silver Wheaton Corp.

Silver Wheaton Corp. (NYSE: SLW) is a silver streaming company that generates revenue from silver production from mines. The company's business model involves buying silver from miners, usually tied to their copper and gold production, and selling the precious metal to manufacturers. Its shares trade at 16 times analysts' earnings forecasts for 2020, which is in line with its five-year average.

Coeur Mining, Inc.

A lesser known player in the silver and gold mining space is Coeur Mining, Inc. (CDE).

Coeur's main asset is its silver-and-zinc-producing Silvertip Mines located in north-central British Columbia. The Silvertip Mines currently produce 6.5 million ounces of silver and 10.2 million pounds of zinc annually. Coeur also has 3.6 million ounces of silver and 2.8 million pounds of zinc in reserves.

Coeur Mining, Inc.'s market capitalization is under $2 billion. The stock trades at a forward P/E of 7.1, which is well below the S&P 500's forward P/E of 12.7. Besides its Silvertip Mines, Coeur also has a 50% interest in the world-class Wharf gold mine in Guyana.

Hecla Mining Company

Hecla Mining Company (HL) is an American gold and silver mining company based out of Coeur d'Alene, Idaho. It has two operating mines and three exploration locations. Hecla's primary mine is the Coeur d'Alene mine, which is considered its highest-grade mine. Hecla's other mines are El Gallo, a high-grade underground mine, and Lucky Friday, an exploration mine.

Hecla Mining Company's stock shot up 17% in 2019. Its stock closed in 2022 trading at $7.86.

New Gold Inc.

New Gold Inc. (NGD) was founded in 2002 and is one of the largest producers of precious metals in the world. New Gold operates five mines, two processing plants, and a research and development facility throughout the U.S., Peru, and Mexico. New Gold's goal is to become a global supplier of precious metals, and has 15 exploration and development projects in various stages throughout the world. New Gold's market cap is $5.1 billion, with $1.3 billion in total revenue in 2020. (For more, see also: 5 Gold Stocks to Watch in 2021.)

Midas Gold Corp.

Midas Gold Corp. (MAX:TSX; MDRPF:OTCQX) is focused on developing its 100%-owned Cascabel Project in Ecuador, which could produce more than 100,000 ounces of gold per year. The mine is expected to begin producing gold by mid-2020. Midas Gold also recently acquired the Veta Grande Project in Peru, which could produce more than 100,000 ounces of gold per year.

Midas Gold has a market cap of $87.4 million and an enterprise value of $129.6 million, based on 2018 year-end numbers. The company has a debt-to-equity ratio of 2.1, and expected EBITDA for 2019 is $43.7 million. Midas Gold has a trailing price-to-earnings ratio of 12.8, based on forecasted earnings for 2019.

Gold IRA: Should You Open One To Save For Retirement?

The Bottom Line

Gold prices have fallen sharply this year, as the U.S. dollar has strengthened against its major rivals. However, prospects for higher gold prices are on the rise, as the Federal Reserve has signaled that it may stop raising interest rates.