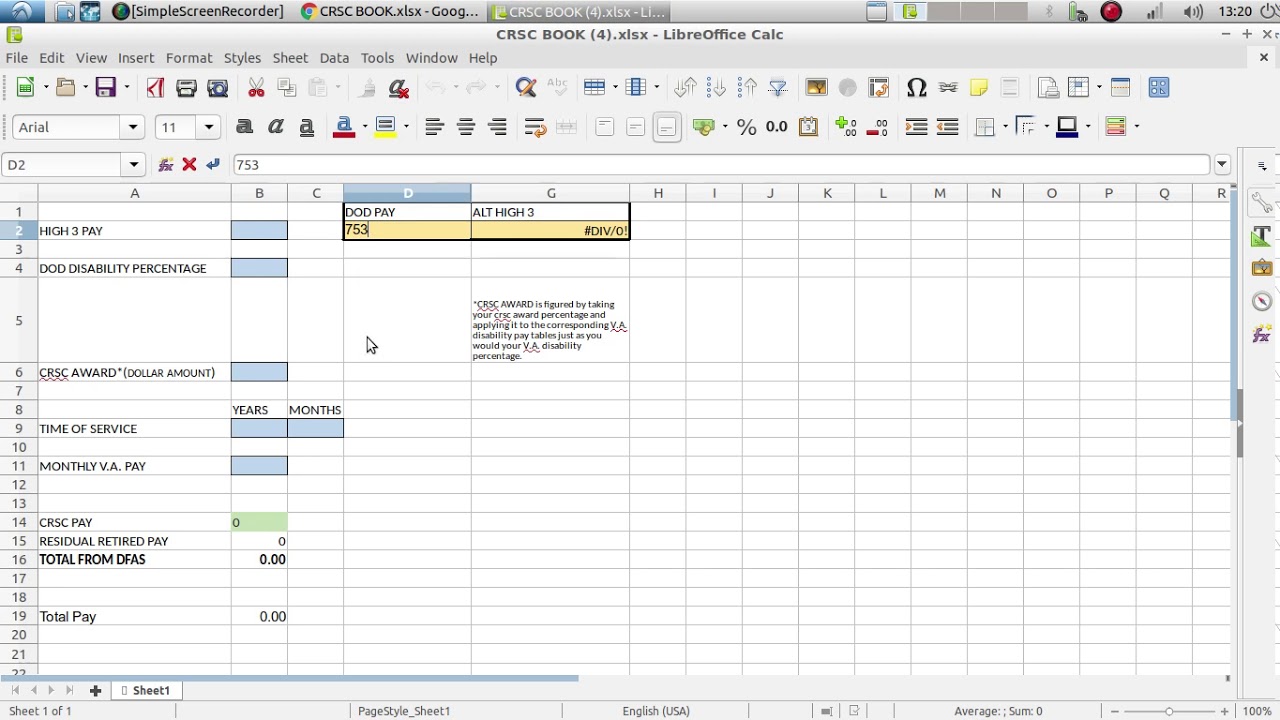

Calculate Your CRD Back Pay using this Calculator

- The Consolidated Reporting Directive (CRD) requires banks to ensure sufficient capital cushions through two mechanisms.

- The first, the buffer ratio, requires banks to hold capital equal to at least 8% of risk-weighted assets.

- The second mechanism, the counter-cyclical buffer, requires banks to hold capital equal to 2.5% of risk-weighted assets.

The Consolidated Reporting Directive (CRD) imposes new requirements on banks in the European Union (EU), requiring them to hold more capital and reduce risk more comprehensively. The directive's impact has been felt across the European Union and, in particular, on banks in noncore European member states, including Greece.

Specifically, the CRD requires banks to ensure sufficient capital cushions through two mechanisms. The first, the buffer ratio, requires banks to hold capital (also known as Tier 1 capital or core capital) equal to at least 8% of risk-weighted assets. The second mechanism, the counter-cyclical buffer, requires banks to hold capital equal to 2.5% of risk-weighted assets.

Calculating Back Pay

While CRD orders provide relief to victims of discrimination, the compensation can be difficult to calculate. To calculate back pay, you'll need the following information:

Year you filed your charge

Date of discrimination

Type of discrimination

Your annual income

Your employer's annual income

Number of years you were discriminated against

Not Yet Retired

If you have less than 20 years of service credit, your CRD back pay is calculated at the 2.5% monthly rate.

20-29.99 Years of Service Credit

If you have 20-29.99 years of service credit, your CRD back pay is calculated at the 1.5% monthly rate.

30+ Years of Service Credit

If you have more than 30 years of service credit, your CRD back pay is calculated at the 2% monthly rate.

Retirement Plan Benefits

U.S. Department of Agriculture (USDA)

The U.S. Department of Agriculture (USDA) provides two useful calculators for USDA's My Retirement Benefits (MyRB) website. You can calculate your retirement benefits under the Civil Service Retirement System (CSRS) or the Federal Employees Retirement System (FERS).

Defined Benefit Plan

The CRD provides three methods for calculating the back pay due employees:

(i) the standard method, which does not require any change in the plan's funding;

(ii) the amortized method, which requires that the plan's funding be increased; and

(iii) the "gross-up" method, which requires the plan's funding be increased but not irrevocably committed.

The "standard" method (C.R.Ramp) is the default method. It requires that a defined benefit plan be funded at least 80% by employers. However, the Pension Protection Act (PPA) of 2006 eliminated this requirement.

The "amortized" method (C.R.Amort) requires the plan's funding be increased (but not irrevocably committed) to 90% for plans with 20 years or more of service, and to 100% for plans with more than 21 years of service.

The "gross-up" method (C.R.Gru) requires the plan's funding be increased but not irrevocably committed to 100%.

The CRD provides calculators that automatically calculate back pay for any of these methods.

Defined Contribution Plan

Step 1: Calculate your compensation

• Total compensation: Total compensation = Compensation + Benefits

• Compensation: Compensation = Salary + Bonus

• Bonus: Bonus = Yearly bonus + Annual bonus + Monthly bonus

Step 2: Identify the 12 months following your termination date

• Bonus amounts: Bonus amounts = Yearly bonus + Annual bonus + Monthly bonus

• Compensation during the 12 months following termination: Compensation during the 12 months following termination = Total compensation - Bonus amounts

Step 3: Calculate the CRD back pay amount

• CRD back pay amount = Compensation during the 12 months following termination - Compensation for those 12 months

Social Security

Calculating back pay involves two steps:

1. Determine your average monthly earnings in your highest-earning 35-quarter period.

2. Multiply your highest 35-quarter earnings by 12 months and divide by 52.

For example, if you earned $40,000 in your highest-earning 35-quarter period, multiply $40,000 by 12, and divide by 52 to get $2,000.

TIP: Use the lowest earnings calculation for month one of your back pay calculation, and use the higher earnings calculation for the last 11 months.

With back pay, you're paid retroactively for Social Security withheld. In other words, you'll be paid back what you should've been paid all along.

Back pay is calculated for quarters ending December 31, 2003, through June 30, 2007.

Unemployment Insurance

In 2021, the average weekly benefit was $1,362.

Social Security

As of Jan. 1, 2021, the Social Security taxable wage base was $86,000.

Federal Employees Retirement System (FERS)

Under the FERS plan, the minimum retirement age is 62.

Disability Insurance

In 2021, the average weekly benefit was $1,143.

Workers’ Compensation

In 2021, the average weekly benefit was $1,402.

Pension

In 2021, the average weekly benefit was $1,064.