The Smart Way to Invest $5 Million

Investing $5 million can seem daunting, but with a smart strategy, it can be a lucrative endeavor. In this article, we'll explore the best ways to invest $5 million to maximize your returns and minimize risk.

Assessing Your Financial Goals

Before investing $5 million, it is important to assess your financial goals. What do you want to achieve with this money? Do you want to grow your wealth, generate passive income, or preserve your assets?

Identifying your financial goals will help you determine the best investment strategy for your $5 million. If you want to grow your wealth, you may consider investing in stocks, real estate, or alternative investments. If generating passive income is your priority, you may want to invest in dividend-paying stocks, rental properties, or bonds. If preserving your assets is important to you, you may consider investing in low-risk assets such as certificates of deposit or municipal bonds.

It is also important to consider your risk tolerance when assessing your financial goals. If you are risk-averse, you may want to invest in low-risk assets, even if it means sacrificing potential returns. If you are comfortable with risk, you may consider investing in high-risk/high-reward assets such as startups or emerging markets.

Diversifying Your Portfolio

| Asset Class | Allocation Percentage |

|---|---|

| Stocks | 40% |

| Bonds | 30% |

| Real Estate | 15% |

| Commodities | 10% |

| Cryptocurrencies | 5% |

Exploring Alternative Investments

Exploring Alternative Investments

While traditional investments like stocks and bonds have their place in a portfolio, many investors with a significant amount of capital to invest are turning to alternative investments as a way to diversify and potentially increase their returns. Alternative investments can include private equity, real estate, hedge funds, and commodities.

One advantage of alternative investments is that they are often less correlated with the stock market, meaning they may perform well even when stocks are in a downturn. However, alternative investments also come with their own set of risks and challenges, such as a lack of liquidity and higher fees.

Investors considering alternative investments should carefully research and understand the investment before committing their capital. It's also important to work with a financial advisor who has experience with alternative investments and can help assess their suitability for your specific financial goals and risk tolerance.

Minimizing Taxes and Fees

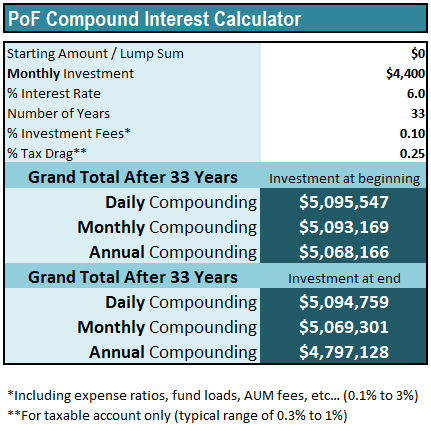

Minimizing Taxes and Fees: When investing $5 million, it's important to consider the impact of taxes and fees on your returns. One way to minimize taxes is to invest in tax-efficient funds, such as index funds or exchange-traded funds (ETFs) that have low turnover rates. Additionally, investing in municipal bonds can provide tax-free income. It's also crucial to consider the fees associated with investment vehicles, such as mutual funds or managed accounts. Look for funds with low expense ratios and consider using a discount brokerage to reduce trading fees. Another strategy is to diversify your investments across different asset classes to minimize the impact of market volatility on your returns. By taking a thoughtful approach to taxes and fees, you can maximize your investment returns and ultimately achieve your financial goals.

Working with a Financial Advisor

When it comes to investing a large sum of money, such as $5 million, it is important to have professional guidance to ensure that your money is working for you in the most efficient and profitable way possible. A financial advisor can help you develop a customized investment plan that aligns with your goals, risk tolerance, and time horizon.

One of the main benefits of working with a financial advisor is their expertise and knowledge of the financial markets. They can provide insights and analysis on economic trends, market conditions, and investment opportunities that you may not have access to on your own. Additionally, they can help you navigate complex financial products and services, such as alternative investments and tax-efficient strategies.

Another advantage of working with a financial advisor is their ability to provide ongoing support and guidance. They can help you monitor your investments, assess your progress toward your goals, and make adjustments as needed. This can be especially important in volatile markets or during times of economic uncertainty.

Gold IRA: Should You Open One To Save For Retirement?