Retire Comfortably With $4 Million

This article explores how having a nest egg of $4 million can provide a comfortable retirement, including financial security and a fulfilling lifestyle.

Factors to Consider When Planning for Retirement

Planning for retirement can be an overwhelming task, but it's never too early or too late to start. Factors to consider when planning for retirement include your current age, your expected retirement age, your current income, your expenses, and your lifestyle. It's also important to consider your health, your family's health history, and any potential medical expenses that may arise in the future.

One key factor to consider when planning for retirement is your savings. Experts suggest aiming for a retirement savings of at least $1 million, but if you want to retire comfortably with $4 million, you'll need to start saving early and consistently. Investing in a mix of stocks, bonds, and other assets can help your savings grow over time.

Another important factor to consider is your retirement lifestyle. What kind of lifestyle do you want to have in retirement? Will you travel frequently, downsize to a smaller home, or pursue expensive hobbies? Calculating your retirement expenses can help you determine how much money you'll need to save to fund your desired retirement lifestyle.

Maximizing Your Retirement Savings

Another way to maximize your retirement savings is to invest wisely. Diversifying your investments can help reduce risk and increase returns. Consider investing in a mix of stocks, bonds, and other assets that align with your financial goals and risk tolerance.

Maximizing your retirement savings also requires careful planning and budgeting. Analyze your expenses and identify areas where you can cut back to free up more money for saving and investing. Create a detailed retirement plan that outlines your goals and the steps you need to take to achieve them.

Finally, don't forget about taxes. Take advantage of tax-advantaged retirement accounts like 401(k)s and IRAs. These accounts offer tax benefits that can help you save more money in the long run.

Creating a Realistic Retirement Budget

| Expense Category | Annual Cost |

|---|---|

| Housing | $30,000 |

| Food and Dining | $12,000 |

| Transportation | $8,000 |

| Healthcare | $10,000 |

| Entertainment | $5,000 |

| Travel | $20,000 |

| Utilities and Bills | $6,000 |

| Miscellaneous | $9,000 |

| Total Annual Expenses | $100,000 |

Note: This is just an example retirement budget and may vary for individuals based on their lifestyle, location, and other factors. It is important to create a personalized budget that fits your specific needs and goals.

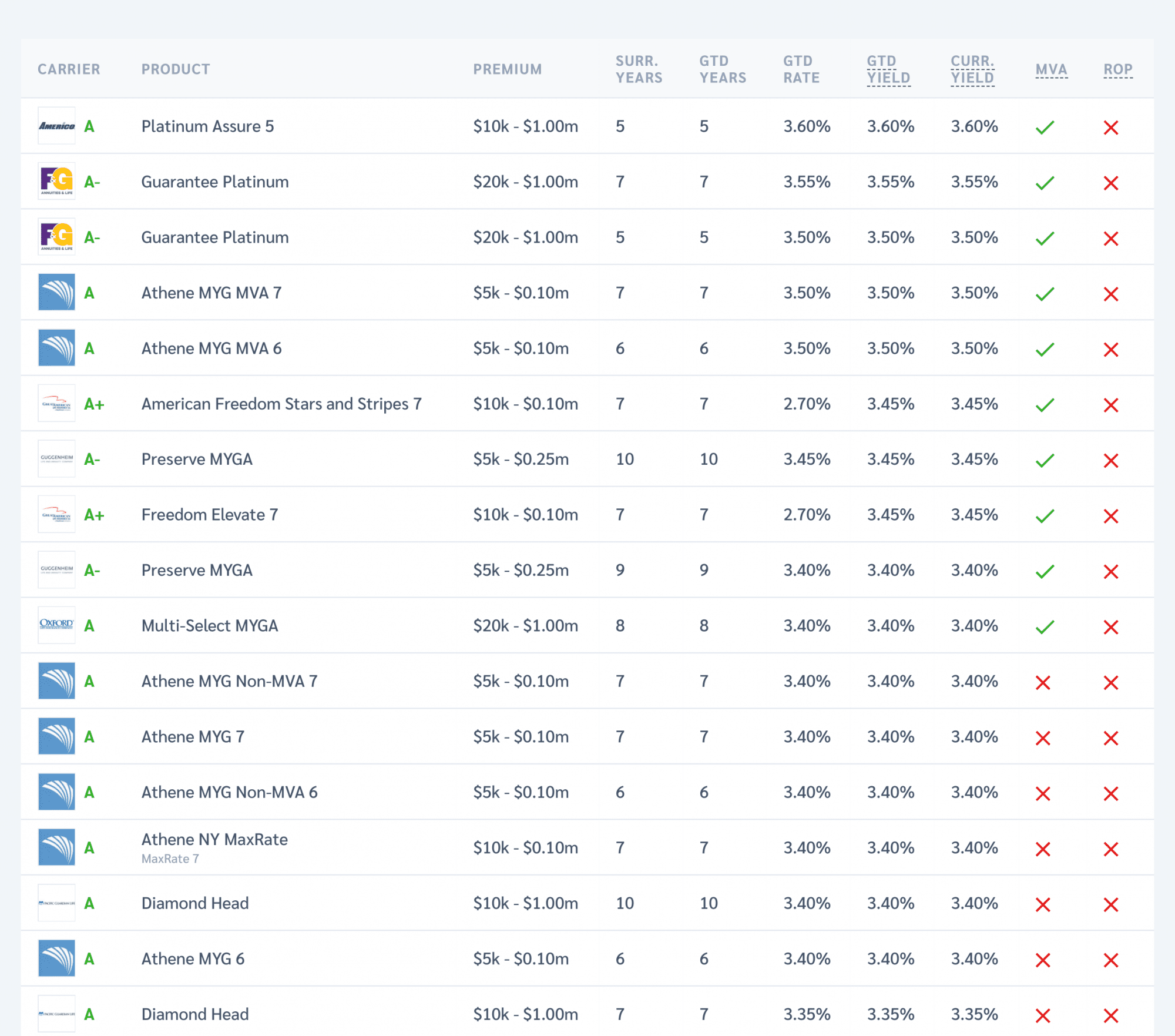

Investment Strategies for a Comfortable Retirement

Investment strategies are crucial in achieving a comfortable retirement, especially if you aim to retire with a substantial amount of money like $4 million. One of the most effective strategies is diversification, which involves spreading your investments across various asset classes, such as stocks, bonds, and real estate. This approach helps mitigate risk and maximize returns.

Another essential strategy is long-term investing. Rather than trying to time the market and make quick profits, focus on long-term growth by investing in a mix of stocks and bonds. This approach allows you to take advantage of compound interest, which can significantly increase your wealth over time.

To further enhance your investment strategy, consider working with a financial advisor who can provide personalized guidance based on your goals and risk tolerance. They can help you determine the right asset allocation and investment vehicles to achieve your retirement objectives.

The Importance of Social Security in Retirement Planning

Social Security plays a crucial role in retirement planning. It provides a source of income to retired individuals who have paid into the system throughout their working years. However, many people tend to overlook the importance of Social Security in their retirement planning process.

One of the biggest misconceptions is that Social Security will provide enough income to retire comfortably. In reality, the average monthly benefit is only around $1,500, which may not be enough to cover all living expenses. That's why it's important to consider additional sources of income, such as pensions, savings, and investments.

Another factor to consider is the age at which you start collecting Social Security benefits. The earliest you can collect benefits is at age 62, but doing so will result in a reduced monthly benefit. Waiting until your full retirement age (between 66 and 67, depending on your birth year) will provide you with a higher monthly benefit. Delaying beyond your full retirement age can result in an even higher benefit.

Lastly, it's important to remember that Social Security was never meant to be the sole source of income in retirement. It should be viewed as a supplement to other sources of income. By incorporating Social Security into your overall retirement plan, you can ensure a more comfortable and secure retirement.

Gold IRA: Should You Open One To Save For Retirement?